“Democracy is the worst form of Government, except for all those other forms that have been tried from time to time,” Sir Winston Churchill once said. January’s attack in Washington, when an armed and angry mob of Trump supporters stormed Capitol Hill and clashed with police has highlighted how fragile democracy is, even in the world’s largest and most successful economy. Meanwhile, the military coup in Myanmar shows how democracy is still a swearword in many frontier countries.

Invest on the Right Side of History

If you agree (and you may not) with Churchill, you may want to know where the revenues of the companies in your portfolio are coming from. After all, an increasingly influential segment of investors want their portfolio aligned with a broader vision of prosperity that goes beyond profits. And if that segment wants more democracy in the companies it is invested in, it may want to see the degree of civil rights of the countries in which its funds are producing revenues.

If we look at the United Nations Sustainable Development Goals, it is clear that democracy is a key theme from Goal 16: Peace Justice and Strong Institutions. The goal says that we must all “promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels”.

This Goal provides a framework for building effective democracies worldwide, recognising that “while there is no one-size-fits-all model of democracy, and each country must find the model that works for its circumstances, there are fundamental characteristics these models need in common to qualify as democracies.

Does this fit with ESG investing? The acronym ESG stands for Environment, Social and Governance. What about the S, then? “This means that we expect companies to be treating their employees and the communities all around them with respect and to be a responsible employer that has a generally positive effect on our society as a whole”, says Elizabeth Stuart, associate analyst Sustainability research for Morningstar.

Where’s the Democracy?

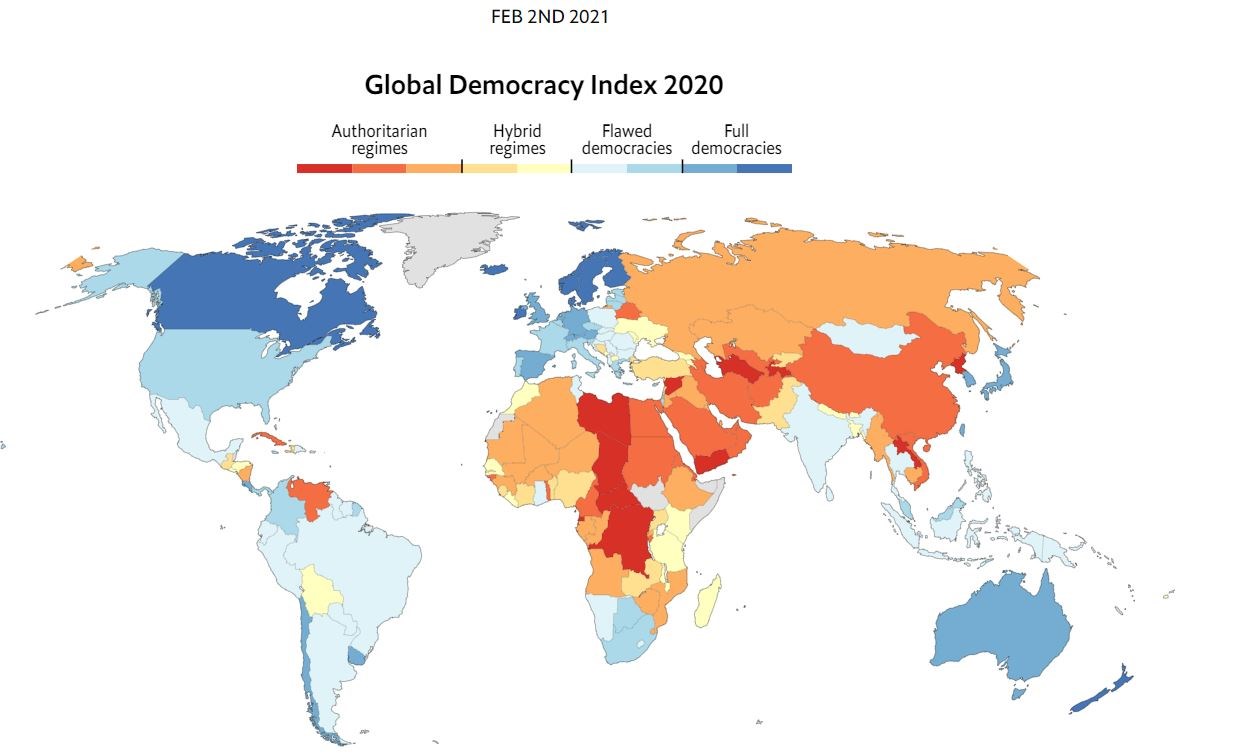

As a base for analysis on revenue and democracy, we can take the Democracy Index devised by the Economist Intelligence Unit (EIU). This Index is based on five categories: electoral process and pluralism, civil liberties, the functioning of government, political participation, and political culture.

Based on scores across 60 indicators within these categories, each country is then classified as one of four types of regimes: full democracy, flawed democracy, hybrid regime or authoritarian regime.

Source: EIU Democracy Index

Let's take, for example, two big economies that, according to EIU, rank in the lower part of the index and are considered authoritarian regimes: China and Russia.

If you are a fierce supporter of democracy you may want to invest in a Finnish equity fund (if it is available in your country). Finland ranks sixth in the EIU index and is considered a full democracy. However, in terms of average revenue exposure, companies in the Finland equity fund category make almost 10% of their revenues in Russia and China jointly. In Sweden (full democracy. Rank 3) equity funds you’ll find an exposure of nearly 9%. In Germany (full democracy. Rank 14) you’ll have an exposure of more than 11%. If you move southward to Spain (full democracy. Rank 22) or Italy (flawed democracy. Rank 29) you’ll get an exposure of almost 5%.

Taking a sector approach is not easy either. The percentage of revenue exposure in China and Russia is roughly 20% if you invest in single categories such as Consumer goods and services, Natural resources or Technology.

China and Russia Revenue Exposure

| Morningstar Category | Revenue Exposure % China | Revenue Exposure % Russia |

| Equity Consumer Goods & Services | 18.77 | 1.68 |

| Equity Natural Resources | 16.85 | 2.37 |

| Sector Equity Technology | 16.13 | 1.48 |

| Germany Equity | 9.15 | 1.97 |

| Sweden Equity | 6.67 | 1.88 |

| Finland Equity | 5.60 | 3.51 |

| Spain Equity | 3.48 | 1.09 |

| Italy Equity | 3.29 | 1.47 |

Source: Morningstar Direct

What Should Investors Do?

- If you are concerned about where the revenue of your funds is coming from in terms of democracy, do your homework and check the holdings in your portfolio.

- Company sites have plenty of information about where they are doing (or are planning to do) business.

- Press releases and newspaper articles are also a good source of news about companies’ strategies.

- Ask your adviser. They may able to check the fund you want to buy. And, by the way, they are obliged to give you all the information you need to take the decision the best suits you.

“The Covid-19 pandemic has put a renewed spotlight on the ‘S’ of ESG and on the importance of building resilient supply chains," says Hortense Bioy, director of sustainability research for Morningstar. "Investors will be asking tougher questions about human rights issues in supply chains, especially as a growing number of investors are keen to make a difference in the world and align their investments with their values.”

How Exposed Is Your Equity?

Get The Global Makeup Of Equity Indexes With Our Free Tool Here