Investors will be able to understand/see the Morningstar view on many more funds after the roll-out of the Morningstar Qualitative Rating. But how does it work?

The Morningstar star rating rates funds on a scale of one to five based on their past performance. The Morningstar Analyst Rating, meanwhile, ranks funds Gold through Bronze, Neutral and Negative based on a number of qualitative factors including the fund’s strategy, fees and parent company, all of which help to determine the likelihood of the fund outperforming its peers over the long-term.

The Morningstar Qualitative Rating uses machine-learning to apply these analyst ratings to funds. The roll-out of the tool will mean that in Asia, for example, the number of funds with a rating will increase by 22 times.

Across, Europe, the Middle East and Asia, more than 1,170 open-ended and exchange-traded funds (ETFs) already have a Morningstar Analyst Rating, but the roll-out of the Morningstar Qualitative Rating will see this rise to more than 29,000 funds, covering more than 104,000 share classes.

“Investors can use the Quantitative Rating, together with our other fund ratings, to improve their fund screening and selection process," says Wing Chan, director of manager research practices at Morningstar Investment Management Asia. "The Quantitative Rating uses an algorithm to extend the objective, rigorous analysis that our manager research analysts conduct, to thousands of additional funds, providing investors with broader coverage.”

The machine-learning model incorporates the decision-making processes of manager research analysts, their past rating decisions, and the data used to support those decisions. This is then applied to funds not covered by Morningstar analysts, to generate a rating comparable to those assigned by the analysts.

The scale for the Quantitative Rating is the same as the Analyst Rating: a five-tier scale with three positive ratings of Gold, Silver, and Bronze; Neutral; and Negative. Funds will either receive an Analyst Rating or a Quantitative Rating, but not both.

How do Rated Funds Perform?

The Quantitative Rating has been used in the US since June 2017 and expanded to EMEA-domiciled funds in March 2018. Since then, we have been tracking its performance and have been encouraged by its ability to sort funds according to their future performance.

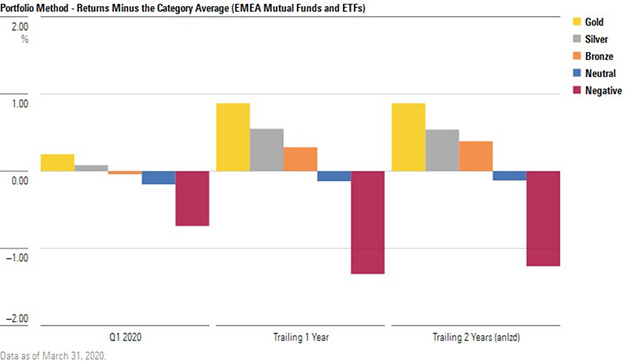

during the recent market events in first-quarterQ1 2020 as well as the trailing one-year and two-year time windows.

To analyse this performance, we create five portfolios that group the fund universe based on their rating. The chart below shows the returns produced by funds in each rating bracket, minus the fund’s category average return.

This allows us to group funds from different asset classes and categories together into the same ratings bucket. For example, the performance of the Gold portfolio would be the outperformance delivered by investing in every gold-rated fund each month on an equal-weighted basis compared to each fund’s category average.

Here we can see that the Medalist funds outperformed their category peers across each time period, while negative funds significantly underperformed the category average. This is exactly the pattern we would hope to see if the ratings system is working as intended.

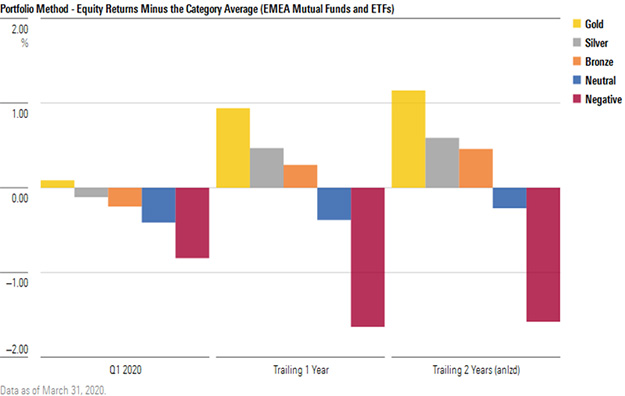

Does Performance Vary by Asset Class?

The same pattern can be seen when we assess performance across different asset classes. The below chart shows the returns delivered by rated equity funds compared to their category average.

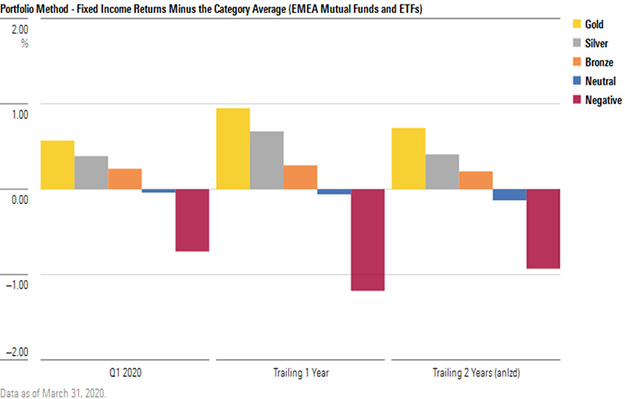

In fixed income, meanwhile, the magnitude of outperformance among Gold-rated funds is a bit lower than in equities, but there is still a pattern of higher-rated funds outperforming lower-rated ones. What is especially notable is that the performance of the ratings system was quite superb during the latest round of market volatility.

How Does This Help Investors?

A reasonable question to ask is whether an investor could actually experience this outperformance or whether these results are merely a result of carefully selected timing or coincidence.

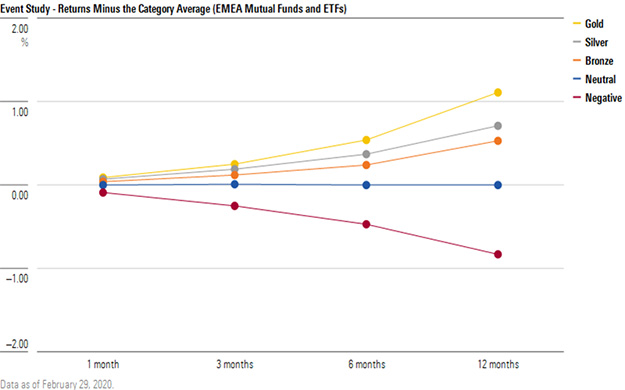

An important test to evaluate ratings efficacy is called an Event Study. This seeks to measure the typical experience an investor would have from using our ratings system on any given day. In other words, what would the typical investor on the typical day have experienced for different holding periods?

The below chart shows that buy-and-hold investors of time periods from one-month to one-year have experienced immediate and lasting cumulative gains from investing according to the Morningstar Quantitative Rating for funds since its launch in March 2018.

For the one-year holding period (regardless of start date), Gold-rated funds tended to outperform category peers by nearly 1 percentage point. Negative-rated funds underperformed category peers by a similar margin.